Outlining the State Budget: “Taxpayers Expect Us to Live within Our Means”

Revised budget fully funds pre–K-12 education growth, cuts $468 million from budget proposed in January with no new taxes.

by Phil Bredesen*

(This was the governor’s address to the General Assembly May 12.)

In the six legislative sessions in which we have now worked together, I have a few times asked to address you at times other than my State of the State presentation. These have typically been occasioned by some change in circumstances in our state, and I am here once again for that reason.

As you well know, we have a substantial revenue shortfall, and I am here to tell you how I propose to address it.

First, let me place our situation in perspective to what’s happening nationally. We are not alone. Across the country, two dozen states face budget shortfalls in the upcoming fiscal year. Our economy is in a recession, and energy costs are soaring. It is a time when businesses have to cut back; it is a time when families have to tighten their belts and defer things they’d like to do. We will do the same.

We in Tennessee government will not on my watch set ourselves above those for whom we work. We’re going to do the work, we’re going to make the choices, we’re going to tighten our belts. I am here proposing a revised budget that keeps us living within our means.

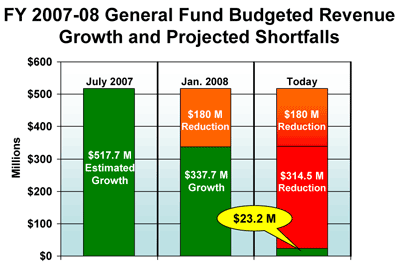

Earlier this year, I submitted to you a lean budget. It was based on the revenue forecasts prepared in December by the Funding Board and represented a cut of about $180 million in the current year and slower growth next year.

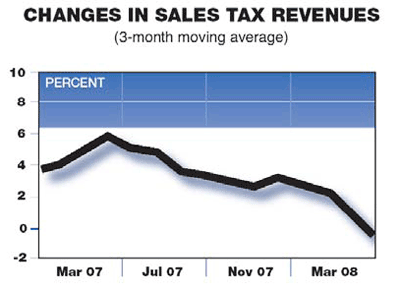

We all shared concerns about the national economy and its impact on our tax collections, although the “R” word — recession — hadn’t yet been used. In the months following my budget submission, the national economy has continued to deteriorate, gas prices have continued their climb, and the “R” word is now freely used.

Because April is such an important month for our revenue collections, I asked the Speakers to delay finalizing the budget until after we knew that month’s results and the Funding Board had the opportunity to review them. It is a good thing that we did so. Those results were released earlier today, and they are startling.

Our budgeting department has revenue and budget figures going back to 1961. In that

almost half-century of records, April 2008 was the worst month Tennessee has ever

encountered. The third quarter of this fiscal year was the second worst quarter in

their records, and the fourth quarter, the one we’re in the middle of right now, is

shaping up to be the worst on record.

Our budgeting department has revenue and budget figures going back to 1961. In that

almost half-century of records, April 2008 was the worst month Tennessee has ever

encountered. The third quarter of this fiscal year was the second worst quarter in

their records, and the fourth quarter, the one we’re in the middle of right now, is

shaping up to be the worst on record.

We can handle this fine; our state is in excellent financial shape, with good reserves. But now that the magnitude of the problem is becoming clear, we need to act decisively and conservatively. This is not a time for a lack of resolve; this is not a time for wishful thinking.

I’m here to propose to you how we get through this.

First, we will make honest cuts. We will use recurring funds to match recurring expenses, and not fall into the trap of using one-time dollars.

Second, we will protect our major reserves — TennCare and the Rainy Day Fund. As large and tempting as these funds may seem, we’ll need them if the national economic situation worsens.

Finally, we will resist calls to take the easy path. We can’t tax our way out of this shortfall. We’ll need to make the changes necessary to live within our means.

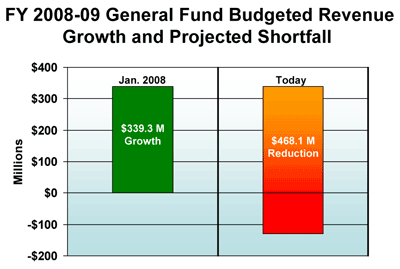

The Funding Board met on May 1 and set new revenue projections for the fiscal year beginning July 1 based on the information we now have available. Those projections imply that we will have to make additional cuts to our budget of between $468 million and $585 million. I have chosen to adopt the lower figure to minimize the impact on employees and programs at this time. We will monitor our revenues over the months ahead, and if it appears that even further cuts are needed, will make them.

With the budget amendment that is being submitted to you, we are making these initial cuts; $468 million of them. Let me walk you through the major elements of this amendment and talk especially about our plan regarding employees.

First of all: Pre–K-12 education. It has been an article of faith for me to always protect education. So I’m pleased to tell you that we continue to fully fund the BEP, and there is an increase in this budget of $59 million for the inflationary costs for both pre-K and the traditional K–12 system.

What we have had to forgo this year is any further filling out of the BEP 2.0

framework or any further expansion of pre-K classrooms.

What we have had to forgo this year is any further filling out of the BEP 2.0

framework or any further expansion of pre-K classrooms.

This is a painful step for me but one that is necessary and that will provide $109 million toward closing our shortfall. Despite foregoing expansion, every classroom and every teacher we pay for today is again paid for, with inflation, in this budget. In Tennessee, education still comes first.

Obviously, to achieve the reductions we need, there are substantial cuts elsewhere:

Higher education has been cut 4.1 percent, or about $56 million. The Tennessee Higher Education Commission will work with the two systems to distribute these cuts appropriately, as they are charged statutorily with doing. I have asked both the University of Tennessee and the Board of Regents to engage in this situation the way we have done in general government: to tighten their belts as much as possible and not simply pass along these reductions to families in the form of large tuition increases.

Capital spending has been cut substantially. As you review the details, the overall reduction may seem steep, but we have put an enormous amount of money into these areas in the past three years, and I believe we can easily take a breather here. Along those lines, we are forgoing the addition to the Rainy Day Fund of $35 million that I proposed this winter.

In TennCare, we are scaling back a planned expansion in order to save another $80 million. No enrollees are lost or benefits changed to achieve this; it comes from deferring a portion of the growth in the medically needy program that we recently had approved by CMS [Centers for Medicare and Medicaid Services].

Meanwhile, the reversion targets — the amount of money the departments are expected to return to the general fund at the end of the year — have been increased to $229 million in the current year.

Unfortunately, it’s not possible to make cuts of the magnitude necessary without affecting our state employees. This is particularly painful for me, as I know it is for each of you. I want our state employees to know how much I value your service and that the actions we are forced to take will be respectful to you and will minimize the negative impact.

We will have to forego the salary increases that were included in my original budget. We will also have to reduce the workforce by 5 percent, or about 2,000 people. We have the ability, under current law, to simply lay off that number of employees. Still, I would prefer — and I know you would prefer — to instead make these changes on a voluntary basis, wherever possible. This is the right thing to do, and it is complicated.

We feel confident that we can complete the design of a buyout shortly. But there are

a number of considerations in federal law to contend with in addition to our own state

laws.

We feel confident that we can complete the design of a buyout shortly. But there are

a number of considerations in federal law to contend with in addition to our own state

laws.

For now, I am asking you to approve $50 million in reserve funds to enable these buyouts. Using one-time funds to reduce payroll is an appropriate and responsible use of our resources.

Over the next three weeks, I am asking our department heads to identify categories of employees, either by classification or business unit, which they in their business judgment feel can most easily be reduced while minimizing the impact on the public.

For example, commissioners might say they can operate with five fewer accountants in the Central Region. Our working approach then is to offer to the accountants in that region buyout packages. If enough employees accept the buyouts, we are done; if not, then there is potentially a layoff.

Please note the underlying principle here: that the buyout is not offered to everyone, but only to those employee classifications for which the department head has committed to a permanent reduction. It does us no good to spend money to buy out an employee who needs to be immediately replaced.

Workforce reductions are difficult. But to once again put our situation in perspective, we are not alone. States across the country are facing similar pressures.

California has issued potential layoff notices to 20,000 teachers, librarians, nurses, and support staff in its education system. California is six times the size of Tennessee, so that is the equivalent here of notifying more than 3,000 of these people in our K–12 system. Minnesota is planning to lay off at least 1,000 teachers and 220 employees in the court system. New Jersey is closing three cabinet departments and reducing its workforce by over 3,000.

By pursuing voluntary buyouts, Tennessee is taking a thoughtful approach. We will know by the end of July if our buyouts have achieved the necessary reduction. I want to be clear, however, that if it is not achieved through voluntary means, there will have to be layoffs this summer. I am doing everything I know to make the buyouts successful so that this will not be necessary.

Finally, what we are undergoing is a reflection in Tennessee of larger forces. This is not simply a “this year” or “next year” issue. The economy will wax and wane. At the same time, our whole relationship with the federal government is changing.

You are already aware of the $70 million hit we have taken this spring from CMS in regard to rule changes affecting Children’s Services. We also face next year a far larger effect in other rules affecting TennCare. Transportation funding has been diminished repeatedly these past few years.

Tennessee, along with the 49 other states, will be going it alone more in the years ahead. We need to start getting ready.

What I have described to you is a solid and fiscally conservative place to be. I am proposing honest reductions to deal with our revenue shortfall.

I’m proposing keeping recurring revenues and recurring expenses in balance. And I’m leaving intact our major reserves — TennCare and the Rainy Day Fund.

In years past, I have used these speeches to try to call you to the altar, to remember the dream of our nation’s founders and the promise of our new land. I’m not going to diminish the sincerity of those calls or trivialize the deep beliefs they reflect by now applying them to a simple budget shortfall — except in this way: I learned in the business world that great ideas are fine and important but that in the end it’s about execution; it’s about doing the work and making the choices to bring those ideas to life.

Tennessee is a great idea; its character, its sensibility, and yes, its conservatism. But right now it is up to those of us in this chamber to execute, to take on the task of balancing our checkbook. Our task is made a little harder by a federal government that seems bent on convincing our citizens that you can have it all; you can write checks that you never have to cover. But Tennesseans know better in their hearts.

I ask you to finish our work by confronting our changed circumstances, making the choices necessary, and once again, as we have so often before, rise above the moment and reveal the true character of Tennessee and her people. Thank you.

Phil Bredesen is the governor of Tennessee.