Outlining the State Budget: “Taxpayers Expect Us to Live within Our Means”

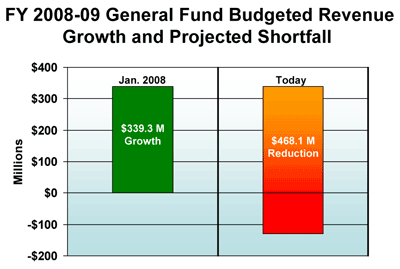

Revised budget fully funds pre–K-12 education growth, cuts $468 million from budget proposed in January with no new taxes.

by Phil Bredesen*

(This was the governor’s address to the General Assembly May 12.)

In the six legislative sessions in which we have now worked together, I have a few times asked to address you at times other than my State of the State presentation. These have typically been occasioned by some change in circumstances in our state, and I am here once again for that reason.

As you well know, we have a substantial revenue shortfall, and I am here to tell you how I propose to address it.

First, let me place our situation in perspective to what’s happening nationally. We are not alone. Across the country, two dozen states face budget shortfalls in the upcoming fiscal year. Our economy is in a recession, and energy costs are soaring. It is a time when businesses have to cut back; it is a time when families have to tighten their belts and defer things they’d like to do. We will do the same.

We in Tennessee government will not on my watch set ourselves above those for whom we work. We’re going to do the work, we’re going to make the choices, we’re going to tighten our belts. I am here proposing a revised budget that keeps us living within our means.

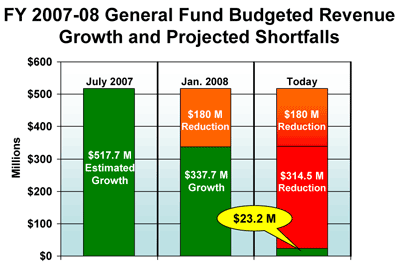

Earlier this year, I submitted to you a lean budget. It was based on the revenue forecasts prepared in December by the Funding Board and represented a cut of about $180 million in the current year and slower growth next year.

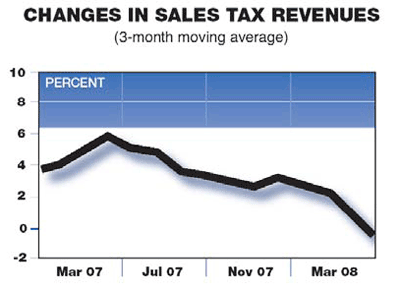

We all shared concerns about the national economy and its impact on our tax collections, although the “R” word — recession — hadn’t yet been used. In the months following my budget submission, the national economy has continued to deteriorate, gas prices have continued their climb, and the “R” word is now freely used.

Because April is such an important month for our revenue collections, I asked the Speakers to delay finalizing the budget until after we knew that month’s results and the Funding Board had the opportunity to review them. It is a good thing that we did so. Those results were released earlier today, and they are startling.

Our budgeting department has revenue and budget figures going back to 1961. In that almost half-century of records, April 2008 was the worst month Tennessee has ever encountered. The third quarter of this fiscal year was the second worst quarter in their records, and the fourth quarter, the one we’re in the middle of right now, is shaping up to be the worst on record.

We can handle this fine; our state is in excellent financial shape, with good reserves. But now that the magnitude of the problem is becoming clear, we need to act decisively and conservatively. This is not a time for a lack of resolve; this is not a time for wishful thinking.

I’m here to propose to you how we get through this.

First, we will make honest cuts. We will use recurring funds to match recurring expenses, and not fall into the trap of using one-time dollars.

Second, we will protect our major reserves — TennCare and the Rainy Day Fund. As large and tempting as these funds may seem, we’ll need them if the national economic situation worsens.

Finally, we will resist calls to take the easy path. We can’t tax our way out of this shortfall. We’ll need to make the changes necessary to live within our means.

The Funding Board met on May 1 and set new revenue projections for the fiscal year beginning July 1 based on the information we now have available. Those projections imply that we will have to make additional cuts to our budget of between $468 million and $585 million. I have chosen to adopt the lower figure to minimize the impact on employees and programs at this time. We will monitor our revenues over the months ahead, and if it appears that even further cuts are needed, will make them.

With the budget amendment that is being submitted to you, we are making these initial cuts; $468 million of them. Let me walk you through the major elements of this amendment and talk especially about our plan regarding employees.

First of all: Pre–K-12 education. It has been an article of faith for me to always protect education. So I’m pleased to tell you that we continue to fully fund the BEP, and there is an increase in this budget of $59 million for the inflationary costs for both pre-K and the traditional K–12 system.

What we have had to forgo this year is any further filling out of the BEP 2.0 framework or any further expansion of pre-K classrooms.

This is a painful step for me but one that is necessary and that will provide $109 million toward closing our shortfall. Despite foregoing expansion, every classroom and every teacher we pay for today is again paid for, with inflation, in this budget. In Tennessee, education still comes first.

Obviously, to achieve the reductions we need, there are substantial cuts elsewhere:

Higher education has been cut 4.1 percent, or about $56 million. The Tennessee Higher Education Commission will work with the two systems to distribute these cuts appropriately, as they are charged statutorily with doing. I have asked both the University of Tennessee and the Board of Regents to engage in this situation the way we have done in general government: to tighten their belts as much as possible and not simply pass along these reductions to families in the form of large tuition increases.

Capital spending has been cut substantially. As you review the details, the overall reduction may seem steep, but we have put an enormous amount of money into these areas in the past three years, and I believe we can easily take a breather here. Along those lines, we are forgoing the addition to the Rainy Day Fund of $35 million that I proposed this winter.

In TennCare, we are scaling back a planned expansion in order to save another $80 million. No enrollees are lost or benefits changed to achieve this; it comes from deferring a portion of the growth in the medically needy program that we recently had approved by CMS [Centers for Medicare and Medicaid Services].

Meanwhile, the reversion targets — the amount of money the departments are expected to return to the general fund at the end of the year — have been increased to $229 million in the current year.

Phil Bredesen is the governor of Tennessee.