Tracking Recovery continued

print pdf | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

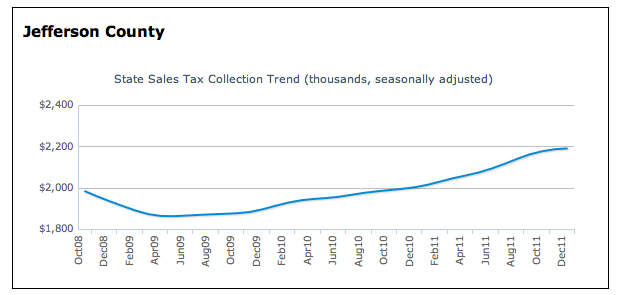

State Sales Tax Collections As important as labor market conditions are, for county officials sales tax collections are of more immediate concern. Of course, the latter follows from the former, but we want to know "the bottom line," in this case what the employment situation means for county finances. Here, too, the Tracking Tennessee's Economic Recovery site provides help. Figure 6 below shows the state sales tax collections trend for Jefferson County. Since collections can fluctuate for reasons unrelated to underlying sales activity, it is better to examine trends rather than month-to-month changes. These data follow the same pattern as described for most of the economic variables previously discussed. Tax collections fell after the economy peaked in December 2007 and then bottomed out in mid-2009 with very slow improvement since that time. Jefferson County's experience parallels the state's sales tax collections, as might be expected. Of all the measures of economic activity included on the site, this picture is the most encouraging. Tennessee consumers are doing their part and would contribute more if the job market improved.

|

|

|

Fig. 6. Jefferson County Sales Tax Collection Trend

|

||